Revolutionize Your Multifamily Marketing Plan: Say Goodbye to Cold Calling

Cold calling has long been a staple in sales strategies, but in today’s multifamily marketing landscape, it’s becoming an outdated and inefficient approach. As buyers have more access to information than ever before, the days of the cold call, where you hope to reach a prospect who has never heard of your property, are increasingly behind us. Let’s explore why cold calling no longer works and how to shift your focus to a more effective multifamily marketing plan.

The Problem With Cold Calling Today

Today’s consumers have grown accustomed to controlling the flow of information. Prospects no longer want to receive unsolicited calls. Instead, they prefer researching their options online at their own pace. The internet allows multifamily buyers to gather information and form their opinions long before they engage in any form of direct communication.

This shift makes traditional cold calling less effective. Buyers can bypass sales pitches by finding answers to their questions online, and when they are ready to take action, they’re more likely to reach out to properties that have already built a relationship with them through strategic online content. This is where the power of content-driven marketing comes into play.

However, time and time again, we see industry professionals who cannot seem to shake the old-school approach. Something to keep in mind is that consumers are not the only ones with access to the internet. You can also use it to stay updated on your target customers’ issues and formulate ways to resolve them.

With access to robust market data and advanced tools, multifamily marketers now can engage prospects with content that aligns with their needs. By understanding your multifamily buyer persona and creating a multifamily brand story that resonates with them, you can generate warm leads that come to you, rather than having to interrupt them with a cold call.

As a commercial real estate marketing agency, we understand the power in numbers.

Content Is the New Cold Call

As much as outbound calls have been the cornerstone of many sales processes, inbound multifamily marketing offers a smarter way to engage prospects. With multifamily content marketing, your property can provide the information prospects need to make informed decisions. Inbound marketing attracts buyers by creating content that speaks directly to their needs and answers their questions before they ever pick up the phone.

Today, more than 75% of consumers say receiving customized content makes them more likely to consider a brand, and 78% are more likely to purchase after engaging with personalized communications. On the other hand, cold calling is a generic, one-size-fits-all approach that fails to meet the buyer where they are. Multifamily inbound strategies provide a more tailored experience, engaging prospects with relevant content that educates, informs, and builds trust.

As a multifamily branding agency, we know that the effectiveness of marketing today relies on content that’s personalized and valuable. Instead of cold calling to persuade prospects to consider your property, you can bring them in with content that addresses their questions, pain points, and goals. From blog posts and white papers to video tours and social media engagement, multifamily branding done well serves as a tool to nurture leads before they ever reach out.

How to Shift Away From Cold Calling: 3 Effective Alternatives

So, how do multifamily marketers successfully build relationships without relying on the outdated practice of cold calling?

Here are a few strategies that can transform your sales approach and increase multifamily lead generation:

1. Network at Industry Events

Building relationships through networking is one of the most effective ways to grow your brand presence without the need for cold calling. Attending events like the National Apartment Association Apartmentalize or the Texas Apartment Association One Conference allows you to engage with other industry professionals and prospective clients.

Networking isn’t about pushing a sale but building trust and rapport. Establishing yourself as an authority in multifamily marketing can lead to speaking engagements, increased credibility, and more leads down the line.

2. Contribute Content to Relevant Publications

Content is a powerful asset in inbound multifamily marketing, and one of the most accessible avenues to build a sense of authority. Publishing articles, guides, and blog posts that answer common renter questions builds your multifamily brand identity and establishes you as an expert.

For example, creating content focused on your city’s “Best Neighborhoods for Young Professionals” or an in-depth guide to moving into an apartment helps foster a relationship with your audience. As your content becomes more aligned with what your multifamily buyer persona is looking for, you’ll see organic traffic rise, leading to more inbound leads without the need for cold calling.

Submit an article to a magazine publisher you know your customers will read, or create your blog. Furthermore, you don’t always have to publish your work. Reposting another blog by a reputable source will help gain attention and credibility.

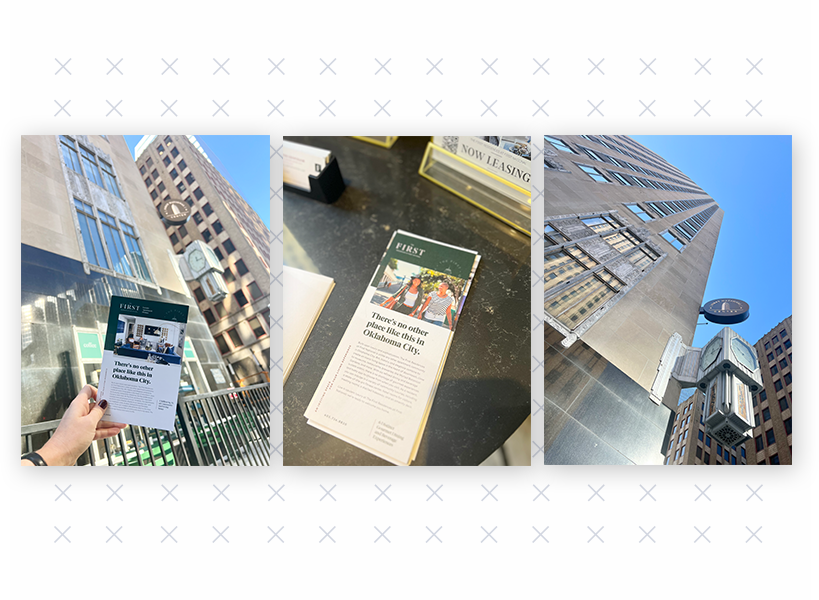

At Criterion.B, our multifamily marketing plan includes guest posts and contributing articles to industry publications. If you take a quick look at our blog, you might notice a couple of guest posts now and then. These are relationships we are continually building. Our team also regularly publishes content for several publications, including the National Apartment Association, Texas Apartment Association, Units Magazine, Multifamily Insiders, and more.

3. Engage Past Customers and Build Relationships

A strong, organic way to grow your business is to focus on existing clients and encourage repeat business. The relationships you build will be at the core of your business. It’s as simple as that. Many of our most successful projects stem from previous clients who contacted us again after experiencing the value of our services. People are willing to pay a higher price when they know they are getting good service.

The multifamily brand story and brand experience you’ve built should continue to resonate with clients over time, keeping them engaged. Building relationships through consistent follow-ups, personalized emails, and providing value through updated services can keep your brand top-of-mind when they’re ready for more. While one customer might not have the budget, resources, or capabilities to become your customer right now, this could change in a year or two, so always keep that line of communication open.

Shifting Your Multifamily Marketing Plan for Success

As a multifamily marketing agency, we understand the need to adapt to an ever-changing digital landscape and adjust your multifamily marketing plan. While cold calling once worked, the modern approach requires a strategic shift toward multifamily inbound marketing. The days of purely relying on outbound efforts are fading as more prospects expect to research and decide based on the content you create. Whether through blog posts, SEO-optimized websites, social media campaigns, or email marketing, the focus is on nurturing relationships, providing valuable insights, and meeting prospects where they are.

With multifamily branding, it’s about creating content that not only speaks to renters’ needs but builds trust and establishes authority in the industry. Once your property has built up a reputation through consistent, engaging content, your multifamily marketing plan becomes less about selling and more about building a genuine relationship with your customers. Through multifamily graphic design, your property can create a compelling online experience that connects with prospective renters on a deeper level.

In the long run, shifting your focus to inbound strategies and moving away from cold calling will lead to more engaged prospects, stronger relationships, and a more sustainable approach to multifamily marketing. The key is creating a unique brand that resonates with your audience and using the right digital marketing tools to amplify your reach and connect with prospective renters before they even need to make a call.

Remember, it doesn’t matter which multifamily marketing plan or strategy you use as long as you treat the customer with the utmost importance.

A Simple Shift That Boosted Sales by 9.5% + How It Can Work for Leasing

Imagine increasing lease conversions and rental revenue without cutting prices, adding amenities, or reworking your multifamily marketing budget.

Sounds too good to be true, right?

But that’s exactly what McDonald’s pulled off with a small yet powerful pricing psychology experiment — and it’s a game-changer that multifamily operators can apply to leasing strategies.

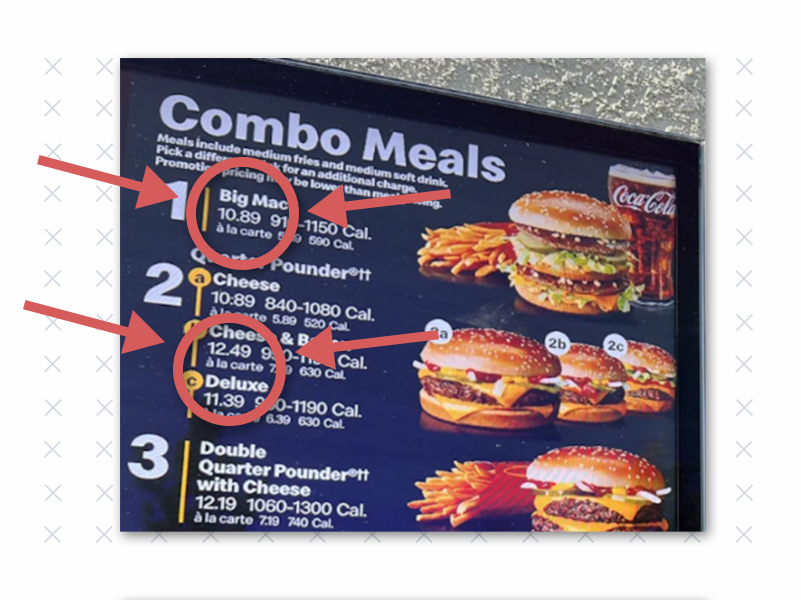

In 2023, McDonald’s made a subtle but brilliant change to how it presented pricing on its menu boards. No discounts, no promotions — just a tweak in how customers saw pricing. The result? A 9.5% increase in global sales and higher average order values.

What does that have to do with multifamily leasing? Everything.

McDonald’s proved that pricing isn’t just about the number — it’s about perception. And in an industry where renters are highly price-sensitive, understanding pricing psychology could be the competitive edge you need.

The Hidden Pain of Pricing — And How to Minimize It

Studies in Neural Computing have found that seeing a currency symbol (like “$”) activates the same brain regions associated with pain. In short, money spent hurts.

That’s why high-end restaurants often ditch the “$” sign, displaying a dish as “18” instead of “$18.” McDonald’s took this concept mainstream with a few key tweaks:

- They moved the price below the item description so customers saw what they wanted before seeing the cost.

- They removed currency symbols to reduce subconscious “pain” when purchasing.

- They increased image sizes by 40% to enhance desire and decrease price sensitivity.

- They highlighted best-sellers to leverage social proof and speed up decision-making.

- The psychology behind this? Desire first, cost second. Customers are more likely to commit when they see what they want before seeing the price.

How Multifamily Can Apply This to Leasing

Most apartment websites and leasing strategies unintentionally trigger price sensitivity. Renters land on a website, see rental rates immediately, and start comparing numbers instead of focusing on the property’s value. But what if we applied McDonald’s pricing hack to multifamily leasing?

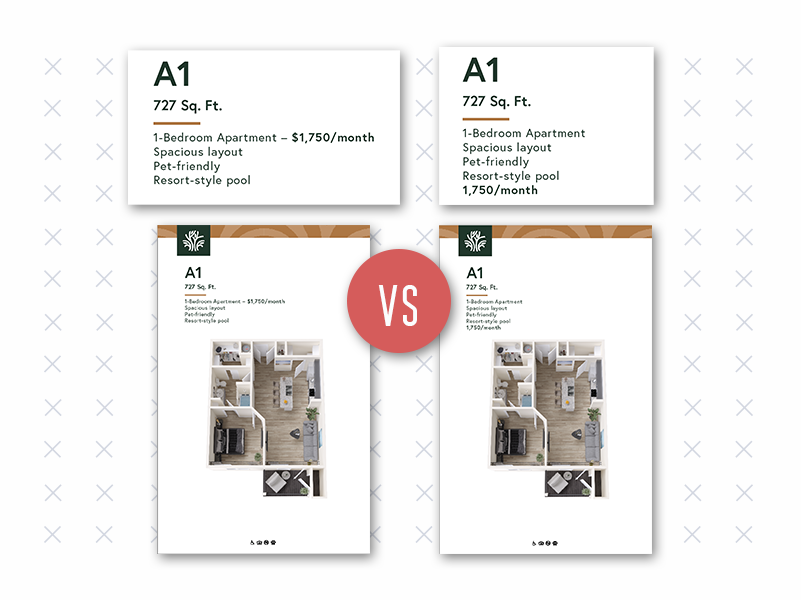

1. Move Pricing Below the Description

Most apartment listings show pricing right next to the unit name or at the top of the page. Instead, let the features and benefits come first.

By placing the price at the end of the description, prospects process desire first, cost second.

2. Remove Currency Symbols Where Possible

If your website allows, show just numbers instead of “$1,750.” It seems small, but even slight reductions in psychological friction can improve conversion rates.

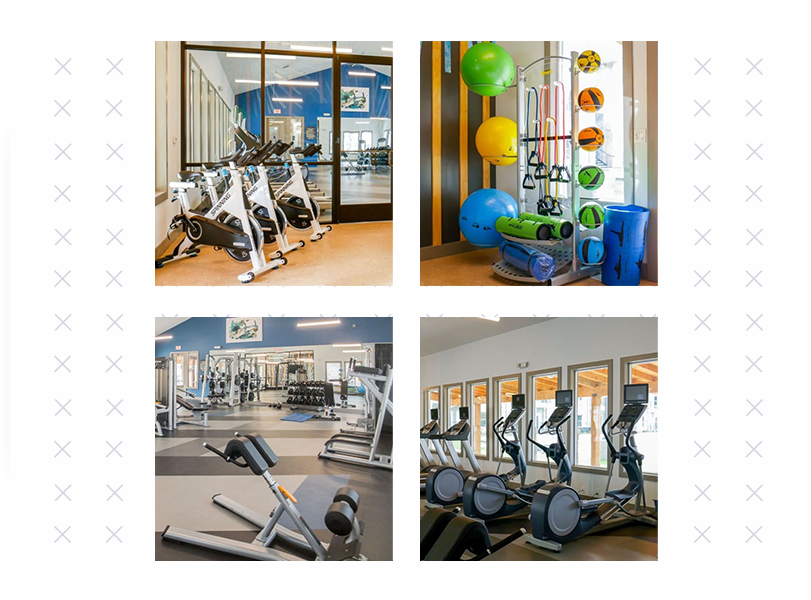

3. Use Larger, High-Impact Visuals

McDonald’s made their food images 40% larger to drive impulse purchases. Multifamily marketers can do the same by ensuring:

- Hero images on websites are lifestyle-focused (people enjoying the space, not just empty rooms).

- Floorplans are big, bold, and interactive, making units feel more tangible.

- Amenities are visualized with engaging imagery instead of just text descriptions.

4. Highlight “Most Popular” or “Renter Favorite” Floorplans

Just like McDonald’s highlighted best-sellers to drive decision-making, positioning select floorplans as popular choices can help renters feel more confident in their decision.

For example:

- “Most Leased Floorplan – Limited Availability”

- “Top Choice for Young Professionals”

- “Renter Favorite – Ask About Move-In Specials”

This nudges prospects toward higher-demand units while shifting focus from cost to value.

Why This Works for Multifamily

McDonald’s proved that pricing isn’t just about affordability — it’s about how people feel when they see the price. In multifamily, rent isn’t just a number; it’s an emotional decision.

When prospects first focus on the lifestyle, the amenities, and the experience, they’re more likely to justify the price as an investment in their ideal living space.

McDonald’s turned menu psychology into billions in extra revenue. Multifamily operators can apply the same principles to leasing — without lowering rent, adding incentives, or offering discounts.

A few small tweaks in how pricing is presented could significantly impact conversions, leasing velocity, and bottom-line revenue.

It’s not about lowering prices — it’s about elevating perception.

Emerging Multifamily Trends in Development and Investment to Keep on Your Watchlist

The industry is experiencing a range of multifamily trends that are set to influence the market. While challenges such as rising construction costs, higher interest rates, and an influx of new supply are present, there are also unique opportunities for multifamily investors, developers, and property managers to navigate this evolving landscape.

Here’s a look at the top 10 multifamily trends shaping the multifamily market in 2025.

1. A Strategic Approach to Market Conditions

With interest rate cuts expected to stimulate the market in late 2025, the focus remains on defensive strategies to manage distressed properties and loans. Many investors are prioritizing short-term bridge financing and creative recapitalization to weather current economic conditions.

Multifamily transaction activity is projected to gradually increase in late 2025 as market stability improves, prompting investors to position themselves for potential growth opportunities.

2. High-Impact Amenity Spaces in Smaller Packages

Developers are optimizing amenity spaces by focusing on quality over quantity. The trend toward “three-season spaces” remains strong, integrating indoor and outdoor elements to maximize usability year-round. Covered patios, glass-enclosed lounges, and hybrid fitness spaces cater to evolving renter expectations without requiring excessive square footage.

Additionally, wellness-focused amenities such as cold plunge pools, infrared saunas, and meditation rooms are gaining popularity, demonstrating that compact spaces can still deliver high-impact experiences.

Multifamily professionals know that the real value in a property lies in offering amenities that appeal to potential renters and align with their evolving expectations and lifestyle needs. Surprisingly, only 15% of multifamily professionals track the usage of their apartment amenities, according to Multifamily Insiders. This gap represents a missed opportunity to tailor offerings that resonate with residents and maximize property value.

Today’s renters are increasingly looking for more than just a place to live — they want a lifestyle that suits their needs and preferences. For example, residents may be willing to commute a bit farther if it means having access to unique amenities like a rooftop lounge, a pet spa, or additional green space. Multifamily professionals have noted that residents are particularly “wowed” by more unconventional offerings such as blow-out hair bars, package lockers, beverage stations, and even crystal lagoons.

3. Location and Amenities as Key Investment Factors

Suburban and garden-style communities remain attractive investments, especially in areas with strong school districts and high barriers to entry. Properties that blend location advantages with desirable amenities continue outperforming competitors, driving long-term resident retention and sustained rent growth.

4. Multifamily Investment Volumes Set to Rebound

Transaction volumes are expected to increase as interest rates stabilize and capital markets become more favorable. Investors should watch for potential pricing corrections in high-supply markets, as well as opportunities to acquire well-located assets below replacement cost.

5. Fewer Investors, More Strategic Opportunities

With some traditional investors pulling back, the market is presenting unique opportunities for well-capitalized buyers. Those with access to liquidity and strong lender relationships will have the chance to acquire prime multifamily assets at competitive pricing in late 2025.

6. Oversupply Challenges in Certain Markets

Major markets that experienced a surge in new development over the past few years face oversupply concerns. Lease-up properties offer aggressive concessions, creating challenges for stabilized assets competing for renters. While long-term demand remains strong, the near-term leasing environment may require strategic pricing and marketing adjustments.

7. Aging Demographics Fueling Senior Housing Demand

As the population aged 80+ grows, senior housing is seeing increased investor interest. While new construction has slowed, demand is rising, leading to increased occupancy rates and potential consolidation within the sector.

8. AI and Tech-Driven Risk Mitigation in Insurance

With rising insurance costs, multifamily owners leverage AI-driven smart home technology to mitigate risks like water damage and fires. Properties implementing predictive maintenance solutions and IoT-enabled monitoring systems are seeing lower premiums and improved coverage terms.

9. Hyper-Targeted Marketing and Localized Outreach

Property managers are prioritizing hyper-localized marketing campaigns, leveraging partnerships with local businesses and influencers to boost engagement. Digital advertising platforms are also enabling more precise audience targeting, helping properties maximize their marketing spend.

For example, partnerships with local sports teams or cultural organizations can enhance a property’s visibility and community presence. This approach is particularly effective in markets where traditional marketing efforts may be less impactful.

Discover 10 more ways to market your business in the multifamily market through partnerships, events, sponsorships, and syndications in our blog.

10. RFlexible Workspaces Driving Renovation Strategies

Coworking-friendly apartments are in high demand, with listings featuring work-friendly amenities receiving 16% more saves and 23% more shares daily. Developers are adapting common areas to include quiet workspaces, high-speed internet, and collaborative meeting spaces to cater to the growing remote-work trend.

These renovated areas often include open kitchens, lounge seating, and work-from-home accommodations designed to create a vibrant and flexible environment for residents. By focusing on these renovations, developers can enhance the appeal of their properties and meet the evolving needs of today’s renters.

Adapting to the Future: Strategies for Multifamily Success

While the multifamily market faces economic headwinds, strategic investments and adaptability will be key to success in 2025. Developers and investors who focus on high-demand locations, technology integration, and evolving renter needs will be best positioned to capitalize on emerging opportunities. Staying ahead of these multifamily trends will ensure a competitive edge in a rapidly evolving landscape.

At Criterion.B, we’re here to help you navigate these changes and maximize the opportunities. If you want to refine your marketing strategy or explore new avenues for growth, contact our team today.

Top Predictions & Multifamily Statistics to “Thrive in ’25”

The mantra “Thrive in ’25” is more than an aspiration — it’s a rallying cry for multifamily professionals navigating an evolving industry. While challenges like rising vacancies and changing renter demographics persist, the multifamily sector is also ripe with opportunities for those who adapt.

2025 signals a transformative period with significant renter expectations, investment patterns, and digital engagement shifts. Here are 11 updated multifamily statistics every executive should keep in mind for this pivotal year:

1. Vacancy Rates Reach 6.5% Amid Record Supply

Vacancy rates have climbed to 6.5%, reflecting the pressure from record-high new construction deliveries. As of January 2025, the national occupancy rate has dropped to 93.9%, its lowest since 2013. This underscores the urgent need for innovative leasing strategies as competition intensifies.

2. Rent Growth Stabilizes at 1.2%

With a 1.2% projected rent growth for 2025, affordability concerns remain at the forefront. This stabilization reflects a balance between maintaining occupancy and addressing renters’ financial constraints as job growth slows in many metro areas.

3. Digital Engagement on the Rise

Most renters now begin their apartment search online with many expecting virtual tours as a standard offering. About 98% of apartment searchers use online resources when looking for their next home and 20% use online sources only. Additionally, 68% of renters are willing to pay more for properties with strong online reputations. Positive reviews are crucial, as renters increasingly trust digital platforms to guide their decisions.

Here are a few more multifamily statistics to note:

- Most renters book tours the same day they discover a property, with over 60% requesting a tour within 24 hours and nearly 25% reaching out within just a few hours.

- Only 9% of renters remembered seeing property information on Instagram. 47% of U.S. adults use Instagram.

- Only 5% remembered seeing property information on TikTok. 33% of U.S. adults use TikTok.

- Only 2% remembered seeing property information on Snapchat. 27% of U.S. adults use Snapchat.

- 41% of renters across all age groups prefer using automated tools to book tours, with this preference reaching 59% for those aged 18-24.

- While nearly 50% of renters expected their search to take at least four months, 86% found a home in three months or less.

4. Sustainability Matters to 65% of Renters

Demand for sustainable housing continues to grow, with 65% of renters actively seeking eco-friendly apartments in 2025, according to Apartments.com. Features like energy-efficient appliances and on-site recycling programs are now non-negotiables for a large portion of the market.

Among the eco-friendly features in high demand, on-site recycling programs and energy-efficient windows emerged as the most coveted by renters, pointing to specific areas where multifamily properties can invest to attract eco-conscious residents.

5. 51% of Renters Consider Smart Home Tech Essential

The demand for smart home technology among renters, especially those with incomes exceeding $100,000, transforms it from a luxury to a necessity. A striking 51% of these renters now consider smart home technology essential, while 48% view property technology (Proptech) as indispensable.

The willingness to invest in these amenities is notable, with over half of the respondents ready to pay an additional 1-10% for properties with advanced technology. Furthermore, nearly three in ten are open to paying at least 11% more, emphasizing the growing significance of proptech in the rental market.

6. Pet Ownership Continues to Shape Renter Preferences

Pet ownership among renters has grown significantly in recent years. By 2023, 59% of renters reported having at least one pet, a notable rise from 46% in 2019. This trend remains strong, as highlighted by the Zillow Consumer Housing Trend Report, which underscores the critical role of pet-friendly policies in rental decisions.

A pet-friendly patch of turf, especially with convenient access to waste bag dispensers, can make a big impact. Rental units highlighting this amenity saw 76% more daily saves and 91% more daily shares, showcasing the strong appeal of thoughtful pet accommodations.

Here are key multifamily statistics from the report:

- The pet filter reigns supreme: Pet-friendly options are the most commonly used search filter on Zillow, with twice as many renters toggling this filter as any other amenity. Over half of Zillow’s rental listings last year were marked as pet-friendly.

- Pets outnumber children in rental households: An impressive 58% of renters report having a pet, compared to just 33% who have a child and 47% who own a plant.

- Restrictions can be deal-breakers: Nearly half of renters (44%) said they passed on properties that banned pets, and 32% avoided rentals with pet breed or size restrictions.

- Pet policies are essential for six in ten renters: For 60% of renters, allowing pets is a decisive factor when choosing a rental. This figure rises to 67% for single-family renters and 57% for multifamily renters.

- Pet policies influence renewals: Among renters who renewed their leases, 60% cited pet-friendly policies as a major reason for staying, alongside factors like affordability (72%) and quiet neighbors (69%).

As renters increasingly prioritize pet ownership, multifamily properties that embrace pet-friendly policies will have a competitive edge. This trend is particularly significant among Gen Z renters, who are becoming a larger market share and showing strong preferences for pet-friendly living. Understanding and catering to these preferences can position properties for greater tenant retention and appeal.

7. Majority of Renters Seek Home Office Space

As remote work shapes renter preferences, coworking spaces and work-friendly amenities are becoming must-haves in multifamily properties. Instead of traditional business centers, renters now prioritize listings featuring dedicated coworking spaces. According to the Zillow study, these listings see 16% more daily saves and 23% more shares, highlighting the growing demand for adaptable, work-focused environments. Offering features like private workstations, high-speed internet, and comfortable lounge areas can make your property stand out to remote workers and hybrid professionals.

8. Gen Z Renters Continue to Shape the Market

Generation Z isn’t just entering the rental market; they’re rapidly transforming it. Gen Z now represents 10% of the rental population, and their preferences — tech-forward amenities, flexible leases, and vibrant community spaces — are reshaping multifamily marketing. At the same time, homeownership for Gen Z remains under 1%, further solidifying their role in the rental market.

9. Multifamily Investment Volumes Begin Recovery

After a 60% drop in investment volumes in 2023, 2025 shows early signs of a rebound, supported by falling interest rates and renewed investor confidence. Multifamily remains a preferred asset class, with federal rate cuts expected to spur activity in Q3 and Q4.

10. 31% of Renters Spend Over 30% of Their Income on Rent

The affordability crisis remains critical, with 31% of renters allocating over 30% of their income to housing costs. Addressing this issue with affordable rent structures and value-added amenities will be key to maintaining tenant satisfaction.

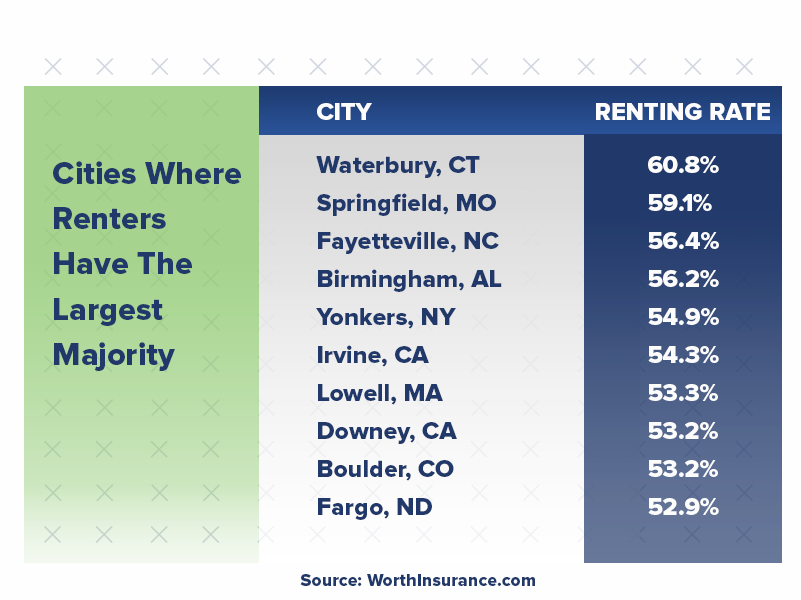

According to iPropertyManagement, homeownership has declined, with 36% of American households now opting to rent rather than own. This shift is significant, reflecting broader economic and societal changes.

Complicating the picture, Flex reports that only 45% of renters feel financially positioned to purchase a property in their city, considering the average home prices. This multifamily statistic is particularly striking when compared to the median household income of homeowners in the U.S., which stands at $72,615. These figures highlight the widening gap between the cost of owning a home and the financial realities facing many renters today.

As we navigate these complex dynamics, the multifamily sector must grapple with the challenge of making housing both accessible and affordable, all while adapting to the evolving preferences and needs of a diverse renter population.

11. AI-Powered HVAC Systems Are Redefining Comfort and Efficiency

Integrating artificial intelligence into HVAC systems transforms how multifamily properties manage indoor climates. Traditional HVAC systems operate reactively, adjusting temperatures based on preset controls. On the other hand, AI takes a proactive and dynamic approach by analyzing real-time data, such as outdoor weather, occupancy patterns, and humidity levels, to optimize comfort and energy efficiency.

For instance, AI systems can determine that maintaining a slightly higher temperature with balanced humidity can provide the same comfort level as a lower temperature setting, thereby reducing energy consumption. This focus on occupant comfort, rather than rigid temperature points, enhances the living experience for residents while contributing to operational savings for property managers.

AI-enabled HVAC systems go beyond temperature control, offering cutting-edge capabilities like:

- Occupancy Awareness: AI learns usage patterns, ensuring energy is only spent on occupied spaces. For example, the system can detect increased activity in shared spaces like gyms and adjust airflow or cooling to maintain comfort.

- IoT Integration: These systems seamlessly connect with devices such as automated blinds and ceiling fans to optimize energy use.

- Predictive Maintenance: AI diagnoses potential issues before they cause system failures, recommending specific actions or parts, reducing downtime, and minimizing costs.

What Do Renters Really Want?

Navigating the multifamily market requires a deep understanding of renter preferences and expectations. A recent survey sheds light on the disconnect and alignment between renters and landlords, offering valuable multifamily statistics for executives aiming to refine their offerings.

Here are the key findings:

- 76% of renters believe landlords have a “pretty” or “very” good understanding of what they desire in a rental property.

- 86% of property managers are confident they understand renter preferences at least well.

- Renters were willing to pay more than property managers expected for three amenities: convenient payment options, guest parking, and flexible lease terms.

- Property managers overestimated renters’ willingness to pay extra for pet-friendliness and proximity to high-quality schools.

- A significant 48% of renters prioritize specific features over affordability.

- In contrast, only 18% of landlords believed that features were more important to renters than affordable rental rates.

These insights underscore the importance of multifamily executives and property managers aligning their offerings with renter preferences, mainly when misconceptions about value and priorities exist. By focusing on the amenities and terms that renters truly value, multifamily properties can better meet the needs of their target audience, ensuring satisfaction and fostering loyalty.

Understanding these multifamily statistics provides multifamily executives with a comprehensive view of the current market trends, renter preferences, and investment dynamics. With this knowledge, industry leaders can devise strategies to address today’s challenges and capitalize on emerging opportunities to ensure sustained growth and success this year.

Rent, Supply, and Demand: Key Multifamily Insights for 2025

The multifamily market continues to evolve, influenced by economic shifts, demographic changes, and emerging industry dynamics. This report delves into the latest data and multifamily trends shaping the industry in 2025, providing valuable insights for investors, developers, and industry professionals.

Multifamily Market Data: An Overview

The multifamily market in 2025 is experiencing a period of recalibration as supply, demand, and economic factors continue to shift. With occupancy rates stabilizing, rent growth slowing in some regions, and construction activity adjusting to rising costs, understanding the latest data is crucial for investors, developers, and property managers navigating this evolving landscape.

- Occupancy Rates: As of January 2025, the national multifamily occupancy rate stands at 94.5%, a slight decrease from previous years, attributed to increased supply in certain regions. (Yardi Matrix)

- Rent Growth: The average asking rent has risen modestly to $1,746, marking a 0.8% year-over-year increase. Notably, markets in the Northeast and Midwest, such as New York City (5.4%) and Detroit (4.1%), have experienced more significant growth. (Yardi Matrix)

- Construction Activity: The multifamily sector is witnessing a deceleration in new construction projects. After a period of robust development, the pace has slowed due to rising interest rates and construction costs, leading to a projected decline in annual completions over the next few years. (The Wall Street Journal)

Key Multifamily Trends and Predictions

- Supply and Demand Dynamics: While demand for rental units remains strong, especially in supply-constrained metros like Chicago and Cleveland, markets that experienced a surge in new deliveries, such as Austin and Phoenix, are seeing elevated vacancy rates and rent declines. (Fannie Mae Multifamily)

- Economic Factors: High mortgage rates and the unaffordability of homeownership are extending rental periods, bolstering demand for multifamily housing. This trend is expected to continue, potentially leading to a landlord-favorable market with rising rents by the end of 2025. (The Wall Street Journal)

- Regional Variations: Sun Belt markets, which previously led in rent growth, are now adjusting to increased supply, resulting in more competitive rental rates. Conversely, the Midwest and Northeast are experiencing steadier growth due to limited new supply. (Yardi Matrix)

Dallas Market Expansion

Dallas continues to be a focal point for multifamily development. The city has welcomed numerous corporate relocations, fueling demand for housing. However, the surge in new constructions has led to a temporary oversupply, moderating rent growth in the short term. Long-term prospects remain positive, supported by a strong job market and population influx.

A Complex Landscape

Experts anticipate that the multifamily market will stabilize as the influx of new supply tapers off and demand remains robust. Investors are advised to monitor regional supply-demand dynamics closely and consider the long-term economic factors influencing rental housing demand.

In summary, the 2025 multifamily market presents a complex landscape with varying regional performances. As the market evolves, it is crucial to stay informed about the latest data, monitor key trends, and leverage multifamily market reports to understand the sector comprehensively. By staying attuned to market dynamics, stakeholders can position themselves for success and capitalize on the opportunities presented by the multifamily market.

Remember, the multifamily market is subject to regional variations and economic fluctuations, so conducting thorough research and consulting industry experts.

Beyond the Booth: Creative Ways to Network at Multifamily Events

We’ve had clients ask us more times than not, “How do I get in front of multifamily?” “How do I market my business beyond my website and digital ads?”

The multifamily landscape is booming with new residents flooding the market and competition fiercer than ever. Whether you’re a seasoned property management firm or a disruptive proptech startup, standing out in this crowded space requires a strategic approach.

To grab the attention of multifamily decision-makers, you need to be where they are and speak their language.

Here are 10 proven ways to put your brand in front of the right people in the multifamily industry:

1. Partnering With Local Syndicators

Syndicators serve as the bridge between real estate investors and multifamily properties. By forging partnerships with these key players in your local market, you can gain valuable access to their network of potential clients. Offer resources, co-host educational events, or sponsor their newsletters to build brand awareness and trust within their investor pool.

2. Leverage Apartment Association Events

Local apartment associations host regular events and conferences that attract property managers, owners, and industry professionals. Participating in these events, like the Apartment Association of Greater Dallas, presents a fantastic opportunity to network, showcase your solutions, and connect with decision-makers directly. Attend workshops, volunteer for committees, or even sponsor the event to maximize your visibility.

3. Don’t Miss National Trade Shows

Major industry events like the National Apartment Association’s Apartmentalize offer unparalleled networking opportunities. Having a well-designed booth with engaging presentations is crucial. But don’t underestimate the power of pre-show outreach and post-event follow-up to nurture those initial connections.

4. Become a Thought Leader Through Content Creation

Multifamily professionals are busy, but they’re hungry for valuable insights. Establish your brand as a trusted resource by contributing informative articles to local and national publications relevant to the industry. Reach out to the Apartment Associations you’re connected with or publications like Multifamily Insiders and Forbes. Offer fresh perspectives, share data-driven insights, and showcase your expertise through compelling content.

5. Network Beyond Events

Networking doesn’t stop at conferences. Join online forums and social media groups frequented by multifamily professionals. Participate in discussions, answer questions thoughtfully, and be a helpful resource.

Attend industry meetups, join local business associations, and don’t hesitate to talk wherever you encounter potential clients. For example, many cities have a monthly “Business Exchange” or “Women in Commercial Real Estate” group you can join, or you can join hundreds of Facebook and LinkedIn groups relevant to your industry.

Here are a few of our favorite multifamily LinkedIn groups:

- Apartment Innovation and Marketing

- Commercial Real Estate Pros

- Commercial Real Estate Referral Network

- Multifamily Executive

- Residential Property Management Professionals

- Multifamily Insiders Community

6. Partner With Property Management Software Providers

Property management software companies have a vast network of users within the multifamily industry. Explore co-marketing opportunities with these software providers. Develop integrations with their platforms, co-host webinars, or offer joint content resources that address common pain points for property managers.

7. Utilize Online Marketing Strategies

Today, a robust online presence is critical. Invest in search engine optimization (SEO) to ensure your website ranks high when multifamily professionals search for relevant solutions. Run targeted social media campaigns on LinkedIn and Facebook to connect with decision-makers. To build a nurturing campaign, offer valuable content like e-books, whitepapers, and webinars in exchange for email addresses.

8. Leverage Customer Success Stories

Don’t underestimate the power of showcasing your success. Highlight positive client testimonials on your website and social media profiles. Consider creating case studies that showcase the quantifiable results you’ve achieved for clients within the multifamily industry.

Want to see some examples? Check out our most recent case studies on our Resource page here.

9. Participate in Industry Awards

Winning industry awards adds credibility and prestige to your brand. Research relevant awards offered by apartment associations, industry publications, or even proptech communities. Compiling a strong case study and submitting your work demonstrates your commitment to excellence and innovation, gaining the attention of potential clients. Even if you don’t win, being involved in these communities might offer you a future opportunity to participate as a judge in these competitions.

10. Build Relationships, Not Just Transactions

It’s important to remember that the multifamily industry is built on relationships. Focus on fostering genuine connections with potential clients. Listen to their challenges, understand their pain points, and tailor your solutions to their needs. By demonstrating genuine care and expertise, you’ll build trust and long-lasting partnerships that fuel your success in the competitive multifamily market.

Implementing these strategies will create a multi-pronged approach to getting in front of multifamily decision-makers. Consistency is key. Continuously put yourself out there, provide value, and cultivate relationships within the multifamily industry. Establishing yourself as a trusted resource and thought leader will attract the right clients and pave the way for your long-term growth and success.

Expert Tips to Avoid Property Management Nightmares

The life of a property manager is a juggling act. You’re responsible for everything from resident relations and maintenance to budgeting and legal compliance. It’s no wonder that mistakes can happen, especially for new property managers or those managing a growing portfolio.

The good news is that by identifying common pitfalls, you can take proactive steps to avoid them.

Here’s a look at some of the biggest mistakes property managers make, along with actionable tips to keep your properties running smoothly:

1. Failing to Properly Screen Residents

A bad resident can be a nightmare for any property manager. They can damage the property, disrupt other residents, and drain your time and resources.

The fix? Implement a thorough screening process that includes credit checks, rental history verification, employment verification, and reference checks. Don’t skip this crucial step — a bad resident can cost you far more in the long run than a thorough screening process ever will.

2. Not Having Clear Lease Agreements

A well-written lease agreement protects both you and your residents. It should clearly outline the rights and responsibilities of both parties, including rent amount, due dates, late fees, pet policies, maintenance procedures, and termination clauses.

The fix? Use a standardized lease agreement that has been reviewed by a lawyer. Keep it updated with any local or state regulations that may change.

3. Letting Maintenance Requests Pile Up

Prompt and thorough maintenance is a cornerstone of successful property management. Like addressing resident complaints quickly, addressing maintenance requests swiftly is essential to avoid a cascade of negative consequences.

Here’s why prioritizing maintenance is crucial:

- Protecting Your Investment: Regular maintenance plays a vital role in preserving the condition of your properties. Neglecting repairs can lead to further deterioration, decreased property value, and higher operating costs. Think leaky faucets that escalate to water damage or clogged gutters that lead to foundation issues. Addressing minor issues promptly saves you money in the long run.

- Resident Satisfaction & Safety: Living in a well-maintained property contributes significantly to resident satisfaction. Ignoring maintenance requests creates frustration and a sense of neglect. Prioritizing repairs ensures a safe and comfortable living environment for your residents.

- Reduced Liability: Letting maintenance issues linger can expose you to legal trouble. For instance, a slip and fall because of an unaddressed ice patch on the sidewalk could result in a lawsuit. By promptly addressing maintenance requests, you’re mitigating potential liability risks.

Here’s how to ensure your properties are well-maintained:

- Routine Inspections: Schedule regular inspections of your properties to identify potential problems before they become major issues. This could involve monthly walkthroughs or annual comprehensive inspections.

- Qualified Contractors: Develop relationships with qualified and reliable contractors who can handle various maintenance tasks. Verify references to confirm licensure and insurance. Oversee the quality and timeliness of their work to ensure efficient repairs.

- Budgeting for Maintenance: Don’t underestimate the importance of budgeting for maintenance and repairs. Factor in routine maintenance costs and a reserve fund for unexpected emergencies and major repairs. This ensures you have the resources readily available when needed.

- Communication Is Key: Like with resident complaints, keep residents informed throughout the maintenance process. Acknowledge their request promptly, explain the repair timeline, and provide updates if any delays occur. Open communication fosters trust and reduces frustration.

4. Poor Communication With Residents

Communication is the cornerstone of any successful business, but it takes on an even greater significance in property management. You’re constantly juggling interactions with a diverse group — your team members, property owners, residents, and vendors. When communication breaks down, it can lead to misunderstandings, conflicts, delays, errors, and ultimately, dissatisfied customers.

Here’s how to ensure smooth communication:

- Establish Clear Channels: Don’t leave your team and renters guessing how to reach you. Set up designated communication channels — email, phone calls, text messages, or online platforms like resident portals. Consistency is key — don’t make them chase you down across multiple platforms.

- Frequency & Transparency: Aim for frequent, transparent communication. Regular updates keep everyone informed and in the loop. Don’t be afraid to share both good and bad news promptly and honestly.

- Tailored Communication: A one-size-fits-all approach won’t work. Tailor your communication style to your audience. Use clear and concise language with residents, provide detailed reports to property owners, and foster open collaboration with your team.

- Feedback & Listening: Communication is a two-way street. Listen to your team and renters’ concerns, questions, and suggestions. Provide positive and constructive feedback to keep everyone motivated and on track. Respond promptly and professionally, demonstrating that their input is valued.

- Technology Advantage: Fortunately, technology is on your side. Utilizing property management software streamlines communication by centralizing information, automating tasks, and facilitating easy access for all parties involved. This reduces the risk of errors and keeps everyone on the same page, boosting overall efficiency.

- Building Relationships: Effective communication goes beyond simply sharing information. It’s about fostering trust and building strong relationships. Schedule regular team meetings to discuss projects, address concerns, and celebrate successes. Open communication fosters a collaborative environment where everyone feels comfortable contributing their best work.

5. Not Keeping Records and Documents

Failing to organize and store important documents properly can lead to a domino effect of problems, including missing records. Missing or disorganized records can make tracking important information (i.e., lease agreements, maintenance requests, and financial transactions) difficult. This can lead to confusion, errors, and wasted time.

Without clear documentation, disputes with residents over rent payments, security deposits, or repairs can become tangled. Without proper records, you may be unable to defend your position in a legal dispute, potentially resulting in hefty fines or even lawsuits.

Here’s how to ensure your records are organized, secure, and accessible:

- Secure Storage: Utilize a secure and accessible system for storing your records. Cloud-based storage solutions offer convenience and accessibility, while traditional filing cabinets can work for paper documents.

- Regular Review and Updates: Don’t let your records become an archive of forgotten paperwork. Schedule regular reviews to ensure all documents are accurate and up-to-date.

- Compliance With Regulations: Retention laws vary depending on your location. Familiarize yourself with the relevant regulations regarding record keeping and disposal. Understanding these requirements ensures you’re adhering to legal mandates.

Effective record-keeping is a fundamental skill in property management. Most real estate transactions involve a mountain of paperwork — lease agreements, maintenance records, financial statements, and more.

Maintaining electronic copies alongside physical documents is essential in today’s digital age. This allows you to access crucial information even when you’re away from the office, ensuring you can always stay on top of your business.

6. Not Taking Advantage of Technology

Many property management software solutions can streamline your workflow and save you time. These tools can help you with tasks like screening residents, collecting rent online, managing maintenance requests, and generating reports. The fix? Research property management software options and find one that fits your needs and budget. Many offer free trials, so you can test them before committing.

7. Not Marketing Your Properties Effectively

Vacancies cost money. There’s no sugarcoating it. A well-defined multifamily marketing strategy is essential to attract qualified residents and keep your properties occupied.

Don’t put all your eggs in one basket. Utilize a diverse range of multifamily marketing channels to reach your target audience. This could include:

- Online Listings: High-quality listings on popular rental platforms are a must-have. If possible, showcase your properties with professional photos, detailed descriptions, and virtual tours.

- Social Media Marketing: Use social media to connect with potential residents. Share engaging social media posts, run targeted ads, and create a community around your properties.

- Website Presence: A professional website is a valuable asset. It lets you showcase your properties, provide leasing information, and establish your brand identity.

- Offline Strategies: Don’t underestimate the power of traditional methods. Yard signs, local print ads, and partnerships with businesses in your area can still be effective ways to reach potential renters.

While a do-it-yourself approach is possible, managing a comprehensive marketing strategy can be time-consuming, especially as your portfolio grows. This is where partnering with a marketing agency can be a game-changer.

Think of a marketing agency as an extension of your multifamily property team. They can provide a wealth of expertise and resources to help you achieve your marketing goals and increase your bottom line.

Here are just a few of the ways a marketing agency can streamline your marketing efforts:

- Streamlined Marketing Collateral: Ordering eye-catching flyers, brochures, and other marketing materials can be a hassle. Criterion.B offers a one-stop shop for designing and ordering all your promotional needs to save time and ensure brand consistency.

- Actionable Analytics & Reporting: A good marketing agency will leverage analytics tools to track the performance of your marketing campaigns. This data can reveal valuable insights into what’s working and what’s not. They can help you set up and track key metrics like website traffic, lead generation, and conversion rates.

- Search Engine Optimization (SEO): Improving your website’s ranking in search results so potential residents can easily find your listings.

- Email Marketing: Creating targeted email campaigns to nurture leads and connect with potential renters.

- Blogging and Content Creation: Developing engaging content that showcases your properties and attracts qualified leads via a blog post.

- Social Media Management: Creating engaging content and managing interactions with potential residents across all social media channels.

- Branding and Design: Developing a strong brand identity for your property management company, including logo design and website creation.

- Website Development and Management: Building a user-friendly website that showcases your properties and provides a seamless leasing experience.

8. Not Staying Up-to-Date on Industry Trends

The property management industry constantly evolves, with new technologies and regulations emerging. Staying informed is important to ensure your business runs as efficiently and effectively as possible.

The fix? Attend industry conferences, webinars, and workshops. Read industry publications and blogs to stay up-to-date on the latest trends.

Want quick marketing tips and multifamily trends delivered straight to your inbox once a week? Sign up for our weekly email list to stay informed!

9. Ignoring Complaints & Not Focusing on Resident Retention

High resident turnover can be a major drain on your resources. It involves advertising costs of vacant units, showing apartments, screening new renters, and processing paperwork. It can also result in a loss of rental income during vacancy periods. But the hidden costs are even greater — negative reviews, a damaged reputation, and a revolving door of unhappy residents.

Here’s how to cultivate a thriving community that keeps renters happy:

- Treat Renters with Respect: Building positive relationships starts with respect, courtesy, and professionalism. Respond to their needs and concerns promptly and effectively.

- Responsive Complaint Resolution: A well-defined system for handling complaints is essential. This includes a clear process for receiving, recording, and resolving issues. Respond quickly to complaints to explain how you’ll address the problem. Keep residents updated throughout the process, and follow up after the repair.

- Value Feedback and Communication: Open and transparent communication is key. Encourage feedback. Regularly solicit their input through surveys, resident meetings, or suggestion boxes. Actively listen to their concerns and suggestions, demonstrating their input is valued.

- Offer Incentives for Renewals: Show your existing renters how much you appreciate them by offering incentives for lease renewals. This could include discounts on rent, free parking, or waived application fees.

- Create a Sense of Community: Help your residents feel like they belong! Organize fun events, create social media groups for them to connect, or offer amenities that encourage interaction. When residents feel like part of a community, not just renters in a building, they’re more likely to want to renew their leases.

10. Micromanaging Your Team & Not Delegating Tasks

Learning the art of delegation becomes increasingly important as your property management portfolio expands. While you may be tempted to hold onto the reins and meticulously manage every detail yourself, this approach is ultimately unsustainable and can hinder your long-term success.

Micromanaging your team can have several negative consequences. It can stifle their motivation, creativity, and sense of autonomy. Constantly hovering over their shoulders can make them feel like they’re not trusted to do their jobs effectively, decreasing morale and productivity.

The solution lies in empowering your team through effective delegation.

- Delegate Based on Strengths: Analyze your team members’ skills, experience, and interests. Assign tasks that align with their strengths and allow them to develop new skills.

- Trust and Autonomy: Once you’ve delegated a task, trust your team to complete it without your constant oversight. Micromanaging every step is a recipe for frustration and resentment.

- Support and Resources: Provide your team with the necessary resources for success, such as training materials, software tools, and clear guidelines.

- Coaching for Growth: Don’t hesitate to offer guidance and support as needed. Regular check-ins and constructive feedback can help your team members grow in their roles.

Often, managers who micromanage their teams worry their employees aren’t doing a good job. If you don’t communicate well with your team or can’t motivate them, they might not feel like doing their best work. Instead of hovering over them, invest in becoming a better leader. Learn how to communicate clearly and build a team environment where everyone feels trusted and responsible for their work.

Remember, you hired your team for a reason — you believe in their skills and potential. Start by delegating smaller projects that allow them to demonstrate their capabilities. As they gain confidence and experience, gradually increase their scope of responsibility. If they hit a roadblock, provide coaching and support to help them develop the skills they need to reach the next level.

Achieve Smart Marketing With a Commercial Real Estate Agency

Imagine this: your meticulously designed office space sits vacant, a pristine canvas gathering dust. Or maybe your trendy apartment community struggles to attract qualified residents despite boasting top-notch amenities.

Simply having a fantastic commercial property isn’t enough. You need a strategic multifamily marketing plan that cuts through the noise and positions your offering as the ideal solution for your target audience.

This is where a commercial real estate marketing agency steps in, acting as your compass and confidant.

We’re talking about more than just slapping a “for lease” sign on the door. A good agency, like Criterion.B, can become your one-stop shop for commercial real estate marketing, encompassing both multifamily and non-residential properties.

Whether you’re a seasoned property owner or a newcomer to the market, navigating the complexities of digital multifamily marketing, crafting a compelling campaign, or establishing a distinct multifamily brand can feel overwhelming. This is where a multifamily marketing agency, like our team at Criterion.B, can be your secret weapon. We specialize in crafting unique brand narratives and developing data-driven strategies that resonate with your target audience.

The Evolving Landscape of Commercial Real Estate Marketing

You can no longer rely solely on traditional methods like print ads and cold calls. Today’s residents and tenants are digitally savvy, demanding a seamless online experience that showcases your property’s unique value proposition. This shift necessitates a comprehensive strategy that integrates various channels, including:

- Digital Marketing: This encompasses website optimization, search engine marketing (SEM), social media marketing (SMM), and targeted online advertising to ensure your property reaches the right audience at the right time.

- Content Marketing: Creating valuable content like blog posts, case studies, and whitepapers establishes you as a thought leader and attracts potential residents actively researching their options.

- Email Marketing: Fostering strong relationships with potential and existing tenants through targeted email campaigns nurtures leads and keeps your property top-of-mind.

- Public Relations (PR): Leveraging media relations and strategic partnerships can enhance your brand reputation and generate positive publicity for your property.

- Data Analytics: Measuring and analyzing marketing campaign performance is crucial for optimizing your strategy and maximizing return on investment (ROI).

Why Partner with a Commercial Real Estate Marketing Agency?

Managing all these diverse marketing elements in-house can be daunting, especially for busy property owners and managers. Here’s where a commercial real estate marketing agency like Criterion.B can be a game-changer:

Expertise and Experience

Our team comprises seasoned professionals who deeply understand the commercial real estate industry and the current marketing landscape. We stay ahead of emerging trends and best practices to ensure your marketing strategy is always optimized.

Strategic Planning and Execution

We work closely with you to understand your specific property goals and target audience. Then, we develop a customized multifamily marketing plan that aligns with your budget and objectives. Our team handles the entire execution process, from content creation and graphic design to campaign management and reporting.

Data-Driven Approach

We leverage data analytics to track the performance of your marketing campaigns and make data-driven decisions that maximize results. We provide you with regular reports and insights to ensure transparency and keep you informed of the impact of your marketing efforts.

Enhanced Brand Storytelling

We help you craft a compelling brand narrative that resonates with your target audience and differentiates your property from competitors. Our team also creates high-quality marketing materials and branded promo items that showcase your property.

Criterion.B: Your Trusted Partner for Commercial Real Estate Marketing Success

At Criterion.B, we believe in the power of strategic marketing to unlock the full potential of your commercial real estate assets. We are passionate about helping our clients achieve their business goals by developing and implementing marketing strategies that generate engagement, improve your brand presence, and set your properties up for success.

Here’s what sets Criterion.B apart:

- Proven track record: We have a proven history of success in helping commercial real estate owners and managers achieve their marketing goals.

- Client-centric approach: We tailor our services to your needs and budget, ensuring you maximize your multifamily marketing investment.

- Data-driven insights: We base our recommendations on data and analytics to ensure your marketing strategy is always optimized for results.

- Creative and innovative solutions: We think outside the box to develop unique and effective marketing campaigns that capture attention and drive results.

- Transparent communication: We keep you informed every step of the way and provide you with regular reports on the performance of your marketing campaigns.

Ready to Take Your Multifamily Property to the Next Level?

If you’re a property manager looking to navigate the complexities of commercial real estate marketing and achieve your goals for your multifamily property, partnering with a qualified agency like Criterion.B is a strategic decision.

Contact us today for a free consultation and discover how we can help you unlock the full potential of your multifamily community. Together, we can create a winning marketing strategy that positions your property at the top of search results for prospective residents.

Imagine this: a seamless online presence showcasing high-quality photos and virtual tours of your stunning floor plans. Our data-driven approach will ensure your multifamily property appears in all the right marketing channels, increasing engagement and bringing more prospects to your leasing agents. Our multifamily branding agency expertise allows us to craft a unique and memorable brand identity to make your property stand out.

Let Criterion.B be your partner in success. We’ll help you develop a comprehensive marketing strategy that leverages the power of various marketing channels, virtual tours, and a strong online presence to showcase your multifamily community and turn interest into satisfied residents.

How to Utilize Google Business Profile to Weather the Storm

The multifamily market is on the brink of a challenging journey through the rocky terrain of the 2024 economy. While the road ahead may seem daunting, there’s a glimmer of hope on the horizon — 2025 promises a bounce-back that could breathe new life into the industry.

Whether you’re an apartment owner, a real estate investor, or a vendor in the multifamily market, safeguarding your digital image can be the key to surviving and thriving in the multifamily landscape until 2025.

Why Online Reputation Management Matters

Your online presence is often the first impression potential tenants, partners, and investors have of your multifamily business. With economic uncertainty looming, this initial impression can make or break crucial relationships. A tarnished online reputation may deter prospects and hinder growth, while a positive one can attract opportunities even in challenging times.

Economic instability can also breed doubt and skepticism. In such times, trust becomes a valuable currency. A well-managed online reputation builds trust by showcasing your commitment to transparency, communication, and customer satisfaction. It assures stakeholders that your multifamily business is resilient, trustworthy, and capable of weathering the storm.

Existing residents and partners are your foundation during economic turbulence. They rely on your ability to provide stability and value. A strong online reputation fosters loyalty and trust among your current stakeholders, reducing turnover and ensuring a more secure revenue stream. It can also differentiate you from rivals who may neglect their online reputation. It demonstrates your dedication to excellence and willingness to go the extra mile, making you the preferred choice for tenants, partners, and investors.

Not to mention, your online reputation is also pivotal in multifamily marketing efforts. Positive reviews, testimonials, and a well-optimized Google Business Profile can be powerful marketing assets, helping you attract new tenants and partners despite the economic challenges.

What’s Contributing to an Unpredictable 2024?

2024 has ushered in a period of unprecedented challenges. Various economic factors have dramatically reshaped the landscape, and navigating these uncharted waters requires a clear understanding of the forces at play. So, what’s contributing to the instability in 2024? And how can you “survive until ‘25?”

1. Economic Uncertainty

The global economic landscape in 2024 has been marked by uncertainty. Factors such as inflation, fluctuating interest rates, and geopolitical tensions have created an atmosphere of unpredictability. As a multifamily professional, it’s crucial to acknowledge this uncertainty and adapt your strategies accordingly.

2. Tenant Financial Strain

Many residents are grappling with financial challenges this year, affecting their ability to pay rent consistently. Eviction moratoriums and rental assistance programs have added complexity to the situation. To address tenant financial strain, offer flexible payment solutions that accommodate their circumstances. This can include payment plans, deferred rent options, and clear communication about available resources and support.

3. Supply Chain Disruptions

Supply chain disruptions have rippled across industries, impacting construction timelines and maintenance efforts. Property development and maintenance delays can affect your multifamily business’s bottom line. Anticipate supply chain disruptions and plan for contingencies. Maintain open communication with contractors and suppliers to address potential delays promptly. Prioritize essential maintenance and renovation projects to ensure resident satisfaction.

4. Market Volatility

The stock market and investment markets have exhibited heightened volatility in 2024. This can influence real estate investment decisions and funding availability.

5. Regulatory Changes

Legislative changes and government policies, including rent control laws and taxation, can impact the multifamily market. Stay informed about local and federal regulations that affect the multifamily industry. Adapt your strategies and business model to align with changing legal requirements.

6. Technological Advancements

Technology continues to reshape the multifamily market. Advancements in property management software, smart home technology, and virtual tours have become essential for staying competitive. Embrace technological advancements to streamline property management and enhance tenant experiences. Invest in user-friendly property management software and explore innovative, cost-effective solutions.

How to Use Google Business Profile to Weather the Storm

Your Google Business Profile can be the guiding light that leads you through the multifamily market’s uncertainties. Your Google Business Profile is crucial for attracting residents and partners and achieving multifamily marketing success. In fact, 56% of user interactions with Google Business listings result in visits to the company’s website, and a business gets noticed in more than 1,000 monthly searches through this platform.

Here is how to utilize your profile to manage your online reputation effectively:

1. Optimize for Accuracy and Appeal

Your Google Business Profile often serves as potential residents’ and partners’ first interaction with your multifamily business. A well-optimized profile creates a positive first impression, essential in an era where online research is prevalent. Ensure that all information on your Google Business Profile is accurate and up-to-date. Include high-quality images of your building, services or amenities, and company details. Craft compelling descriptions that highlight the unique features and benefits of your business.

2. Keyword Optimization

In a highly competitive multifamily market, local visibility is crucial. Optimizing your Google Business Profile enhances your chances of appearing in local search results when individuals are looking for apartments or related services in your area. Utilize relevant keywords in your profile description and posts. This will improve your profile’s search engine rankings, making it more likely to appear in local search results.

3. Encourage Positive Reviews

Customer reviews and ratings on your profile can significantly impact your reputation and influence the decisions of potential customers and partners. Actively encourage satisfied customers and partners to leave positive reviews on your profile. Respond promptly and professionally to all positive or negative reviews, demonstrating your commitment to satisfaction and resolving issues.

4. Utilize Messaging and Appointment Booking

Your Google Business Profile offers convenient communication channels. Streamlined communication can be a competitive advantage, especially during these uncertain times. Enable messaging on your profile to facilitate quick inquiries from potential customers. Additionally, utilize appointment booking features to make it easy for prospects to schedule tours or consultations with your team.

5. Monitoring and Analytics

Google provides valuable insights into how users interact with your profile, including the number of clicks, calls, and direction requests. Regularly monitor the analytics of your profile to assess its performance. Use these insights to make data-driven decisions and continually improve your profile’s effectiveness in attracting tenants and partners.

6. Multifamily Marketing Synergy

Your profile should align seamlessly with your multifamily marketing efforts. It serves as an extension of your brand and marketing strategy. Ensure that the branding and messaging on your profile align with your broader multifamily marketing strategy. Consistency across all platforms enhances your brand’s credibility and recognition.

Preparation for 2025

Surviving until 2025 in the multifamily market may seem arduous, but it’s brimming with potential. While the current state of the multifamily market may be uncertain, focusing on online reputation management positions you for success in 2025 and beyond.

Managing your online reputation isn’t just a choice; it’s necessary during this transformative period. The path may be challenging, but with effective reputation management, you can navigate it confidently and emerge stronger on the other side.

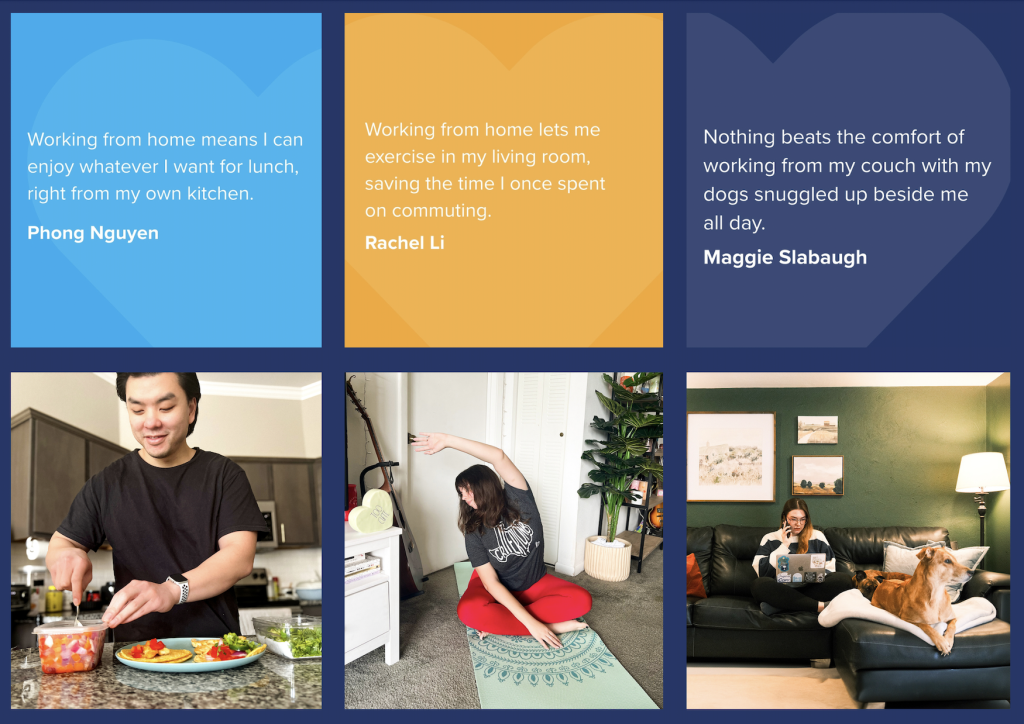

Building a High-Scale Remote Business

It’s true. Remote work is the way of the future; at least, for many industries. And Criterion.B is no exception.

Since January 2020, our entire team has been working remotely, and we haven’t looked back. This shift hasn’t just benefited our work-life balance; it’s actually helped us build a stronger, more connected team.

While working remotely is not a suitable avenue for all businesses, it can offer many benefits to small and large companies when executed correctly.

However, senior leadership often struggles with the real-world implications of building a remote team. How do you know your employees are working? Are there ways you can help them feel connected, even though they are miles apart?

These are the questions managers face when developing a remotely distributed team. Let’s dive into some of the major benefits of working remotely (plus, how it’s been successful for our team!)

1. Hiring Without Geographic Limitations

Working remotely allows companies to hire new members without geographic limitations. This enables them to hire the very best candidates globally without worrying about location restrictions. At Criterion.B, we have employees from coast to coast (literally in Alaska and all the way over to New York — plus several in between!)

Several studies have revealed that remote workers are happier and more productive than those working in an office. With so many distractions in today’s office world, employees ultimately work longer hours to compensate for lost time.

If you ask any member of our Criterion.B team what their impressions are of working remotely, they often answer: “I’m getting so much more work done!” If you can control your work environment, then you are more productive.

2. More Time for What Matters

Let’s face it — commuting can be a real time-sucker. By eliminating the daily grind, our team has gained valuable hours back in their day. This translates to increased productivity and the flexibility to tackle tasks when they feel most focused.

3. Closer Than Ever (Even When We’re Miles Apart)

Sure, we miss the occasional office snack break, but we’ve found creative ways to stay connected. We hold regular virtual team-building events, from epic online escape rooms to trivia nights fueled by friendly competition. And who says remote work means missing out on real-life interaction? Every year, we gather for a massive team-building retreat. This past year, we explored the scenic trails of Broken Bow, Oklahoma, tested our teamwork skills in a challenging escape room, and celebrated our accomplishments over delicious meals and drinks.

While we work independently, we never feel isolated. Our team chats are filled with lively discussions, from brainstorming sessions to sharing funny pet videos (because, let’s be honest, who doesn’t love a good dog picture?). We even have dedicated Slack channels for shared interests, fostering a sense of camaraderie that goes beyond work projects.

4. Finding the Perfect Balance

Remote work isn’t just about convenience; it’s about empowering our team to thrive both personally and professionally. For example, some of our team members can now catch their kids’ soccer game without rushing out of the office or can feel confident in still getting their work done even when one of their kids is home sick from school.

Building a Culture of Trust and Transparency

Remote work hinges on trust. At Criterion.B, we empower our team members to manage their time effectively and hold them accountable for their results. We prioritize clear communication, using project management tools and frequent check-ins to keep everyone on the same page.

The Trust Factor

When working remotely, successful implementation all boils down to trust.

“How do you know when a person is working?” Well, how do you know they are working when they are in the office? Trust.

Ultimately, it’s all about trusting your remote workers. At Criterion.B, we trust our team but check in regularly. Whether through periodic check-ins to see what projects are on their plate or a weekly one-on-one video call, our team articulates their goals clearly and then follows up to track the employee’s work product.

A successful remote team requires effort and planning (by both the employees and leaders), but the rewards are undeniable. At Criterion.B, we’ve embraced the remote work revolution and are excited to see the future for our distributed — yet incredibly close-knit — team.