Top Predictions & Multifamily Statistics to “Thrive in ’25”

The mantra “Thrive in ’25” is more than an aspiration — it’s a rallying cry for multifamily professionals navigating an evolving industry. While challenges like rising vacancies and changing renter demographics persist, the multifamily sector is also ripe with opportunities for those who adapt.

2025 signals a transformative period with significant renter expectations, investment patterns, and digital engagement shifts. Here are 11 updated multifamily statistics every executive should keep in mind for this pivotal year:

1. Vacancy Rates Reach 6.5% Amid Record Supply

Vacancy rates have climbed to 6.5%, reflecting the pressure from record-high new construction deliveries. As of January 2025, the national occupancy rate has dropped to 93.9%, its lowest since 2013. This underscores the urgent need for innovative leasing strategies as competition intensifies.

2. Rent Growth Stabilizes at 1.2%

With a 1.2% projected rent growth for 2025, affordability concerns remain at the forefront. This stabilization reflects a balance between maintaining occupancy and addressing renters’ financial constraints as job growth slows in many metro areas.

3. Digital Engagement on the Rise

Most renters now begin their apartment search online with many expecting virtual tours as a standard offering. About 98% of apartment searchers use online resources when looking for their next home and 20% use online sources only. Additionally, 68% of renters are willing to pay more for properties with strong online reputations. Positive reviews are crucial, as renters increasingly trust digital platforms to guide their decisions.

Here are a few more multifamily statistics to note:

- Most renters book tours the same day they discover a property, with over 60% requesting a tour within 24 hours and nearly 25% reaching out within just a few hours.

- Only 9% of renters remembered seeing property information on Instagram. 47% of U.S. adults use Instagram.

- Only 5% remembered seeing property information on TikTok. 33% of U.S. adults use TikTok.

- Only 2% remembered seeing property information on Snapchat. 27% of U.S. adults use Snapchat.

- 41% of renters across all age groups prefer using automated tools to book tours, with this preference reaching 59% for those aged 18-24.

- While nearly 50% of renters expected their search to take at least four months, 86% found a home in three months or less.

4. Sustainability Matters to 65% of Renters

Demand for sustainable housing continues to grow, with 65% of renters actively seeking eco-friendly apartments in 2025, according to Apartments.com. Features like energy-efficient appliances and on-site recycling programs are now non-negotiables for a large portion of the market.

Among the eco-friendly features in high demand, on-site recycling programs and energy-efficient windows emerged as the most coveted by renters, pointing to specific areas where multifamily properties can invest to attract eco-conscious residents.

5. 51% of Renters Consider Smart Home Tech Essential

The demand for smart home technology among renters, especially those with incomes exceeding $100,000, transforms it from a luxury to a necessity. A striking 51% of these renters now consider smart home technology essential, while 48% view property technology (Proptech) as indispensable.

The willingness to invest in these amenities is notable, with over half of the respondents ready to pay an additional 1-10% for properties with advanced technology. Furthermore, nearly three in ten are open to paying at least 11% more, emphasizing the growing significance of proptech in the rental market.

6. Pet Ownership Continues to Shape Renter Preferences

Pet ownership among renters has grown significantly in recent years. By 2023, 59% of renters reported having at least one pet, a notable rise from 46% in 2019. This trend remains strong, as highlighted by the Zillow Consumer Housing Trend Report, which underscores the critical role of pet-friendly policies in rental decisions.

A pet-friendly patch of turf, especially with convenient access to waste bag dispensers, can make a big impact. Rental units highlighting this amenity saw 76% more daily saves and 91% more daily shares, showcasing the strong appeal of thoughtful pet accommodations.

Here are key multifamily statistics from the report:

- The pet filter reigns supreme: Pet-friendly options are the most commonly used search filter on Zillow, with twice as many renters toggling this filter as any other amenity. Over half of Zillow’s rental listings last year were marked as pet-friendly.

- Pets outnumber children in rental households: An impressive 58% of renters report having a pet, compared to just 33% who have a child and 47% who own a plant.

- Restrictions can be deal-breakers: Nearly half of renters (44%) said they passed on properties that banned pets, and 32% avoided rentals with pet breed or size restrictions.

- Pet policies are essential for six in ten renters: For 60% of renters, allowing pets is a decisive factor when choosing a rental. This figure rises to 67% for single-family renters and 57% for multifamily renters.

- Pet policies influence renewals: Among renters who renewed their leases, 60% cited pet-friendly policies as a major reason for staying, alongside factors like affordability (72%) and quiet neighbors (69%).

As renters increasingly prioritize pet ownership, multifamily properties that embrace pet-friendly policies will have a competitive edge. This trend is particularly significant among Gen Z renters, who are becoming a larger market share and showing strong preferences for pet-friendly living. Understanding and catering to these preferences can position properties for greater tenant retention and appeal.

7. Majority of Renters Seek Home Office Space

As remote work shapes renter preferences, coworking spaces and work-friendly amenities are becoming must-haves in multifamily properties. Instead of traditional business centers, renters now prioritize listings featuring dedicated coworking spaces. According to the Zillow study, these listings see 16% more daily saves and 23% more shares, highlighting the growing demand for adaptable, work-focused environments. Offering features like private workstations, high-speed internet, and comfortable lounge areas can make your property stand out to remote workers and hybrid professionals.

8. Gen Z Renters Continue to Shape the Market

Generation Z isn’t just entering the rental market; they’re rapidly transforming it. Gen Z now represents 10% of the rental population, and their preferences — tech-forward amenities, flexible leases, and vibrant community spaces — are reshaping multifamily marketing. At the same time, homeownership for Gen Z remains under 1%, further solidifying their role in the rental market.

9. Multifamily Investment Volumes Begin Recovery

After a 60% drop in investment volumes in 2023, 2025 shows early signs of a rebound, supported by falling interest rates and renewed investor confidence. Multifamily remains a preferred asset class, with federal rate cuts expected to spur activity in Q3 and Q4.

10. 31% of Renters Spend Over 30% of Their Income on Rent

The affordability crisis remains critical, with 31% of renters allocating over 30% of their income to housing costs. Addressing this issue with affordable rent structures and value-added amenities will be key to maintaining tenant satisfaction.

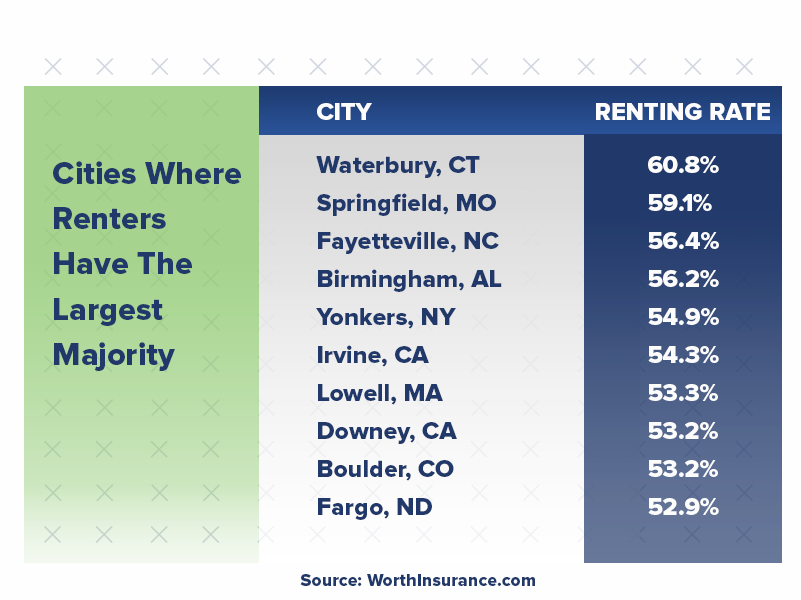

According to iPropertyManagement, homeownership has declined, with 36% of American households now opting to rent rather than own. This shift is significant, reflecting broader economic and societal changes.

Complicating the picture, Flex reports that only 45% of renters feel financially positioned to purchase a property in their city, considering the average home prices. This multifamily statistic is particularly striking when compared to the median household income of homeowners in the U.S., which stands at $72,615. These figures highlight the widening gap between the cost of owning a home and the financial realities facing many renters today.

As we navigate these complex dynamics, the multifamily sector must grapple with the challenge of making housing both accessible and affordable, all while adapting to the evolving preferences and needs of a diverse renter population.

11. AI-Powered HVAC Systems Are Redefining Comfort and Efficiency

Integrating artificial intelligence into HVAC systems transforms how multifamily properties manage indoor climates. Traditional HVAC systems operate reactively, adjusting temperatures based on preset controls. On the other hand, AI takes a proactive and dynamic approach by analyzing real-time data, such as outdoor weather, occupancy patterns, and humidity levels, to optimize comfort and energy efficiency.

For instance, AI systems can determine that maintaining a slightly higher temperature with balanced humidity can provide the same comfort level as a lower temperature setting, thereby reducing energy consumption. This focus on occupant comfort, rather than rigid temperature points, enhances the living experience for residents while contributing to operational savings for property managers.

AI-enabled HVAC systems go beyond temperature control, offering cutting-edge capabilities like:

- Occupancy Awareness: AI learns usage patterns, ensuring energy is only spent on occupied spaces. For example, the system can detect increased activity in shared spaces like gyms and adjust airflow or cooling to maintain comfort.

- IoT Integration: These systems seamlessly connect with devices such as automated blinds and ceiling fans to optimize energy use.

- Predictive Maintenance: AI diagnoses potential issues before they cause system failures, recommending specific actions or parts, reducing downtime, and minimizing costs.

What Do Renters Really Want?

Navigating the multifamily market requires a deep understanding of renter preferences and expectations. A recent survey sheds light on the disconnect and alignment between renters and landlords, offering valuable multifamily statistics for executives aiming to refine their offerings.

Here are the key findings:

- 76% of renters believe landlords have a “pretty” or “very” good understanding of what they desire in a rental property.

- 86% of property managers are confident they understand renter preferences at least well.

- Renters were willing to pay more than property managers expected for three amenities: convenient payment options, guest parking, and flexible lease terms.

- Property managers overestimated renters’ willingness to pay extra for pet-friendliness and proximity to high-quality schools.

- A significant 48% of renters prioritize specific features over affordability.

- In contrast, only 18% of landlords believed that features were more important to renters than affordable rental rates.

These insights underscore the importance of multifamily executives and property managers aligning their offerings with renter preferences, mainly when misconceptions about value and priorities exist. By focusing on the amenities and terms that renters truly value, multifamily properties can better meet the needs of their target audience, ensuring satisfaction and fostering loyalty.

Understanding these multifamily statistics provides multifamily executives with a comprehensive view of the current market trends, renter preferences, and investment dynamics. With this knowledge, industry leaders can devise strategies to address today’s challenges and capitalize on emerging opportunities to ensure sustained growth and success this year.