Emerging Multifamily Trends in Development and Investment to Keep on Your Watchlist

The industry is experiencing a range of multifamily trends that are set to influence the market. While challenges such as rising construction costs, higher interest rates, and an influx of new supply are present, there are also unique opportunities for multifamily investors, developers, and property managers to navigate this evolving landscape.

Here’s a look at the top 10 multifamily trends shaping the multifamily market in 2025.

1. A Strategic Approach to Market Conditions

With interest rate cuts expected to stimulate the market in late 2025, the focus remains on defensive strategies to manage distressed properties and loans. Many investors are prioritizing short-term bridge financing and creative recapitalization to weather current economic conditions.

Multifamily transaction activity is projected to gradually increase in late 2025 as market stability improves, prompting investors to position themselves for potential growth opportunities.

2. High-Impact Amenity Spaces in Smaller Packages

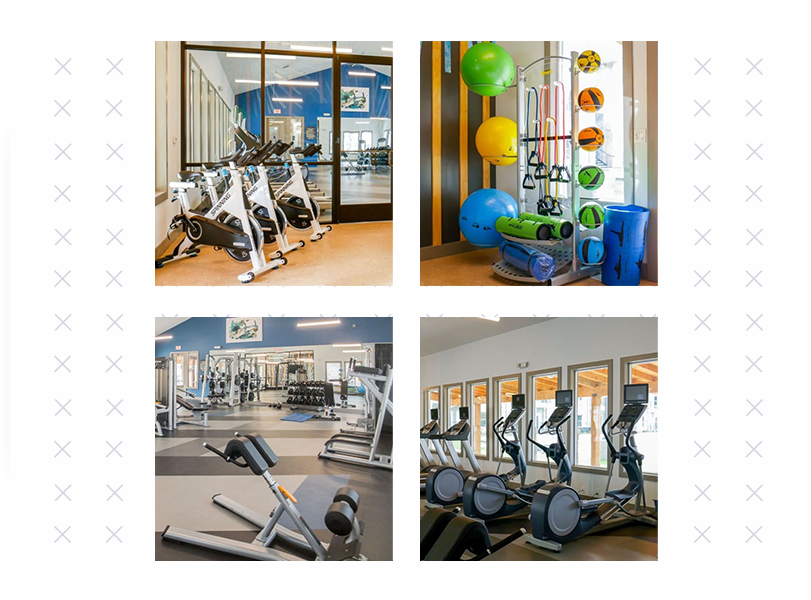

Developers are optimizing amenity spaces by focusing on quality over quantity. The trend toward “three-season spaces” remains strong, integrating indoor and outdoor elements to maximize usability year-round. Covered patios, glass-enclosed lounges, and hybrid fitness spaces cater to evolving renter expectations without requiring excessive square footage.

Additionally, wellness-focused amenities such as cold plunge pools, infrared saunas, and meditation rooms are gaining popularity, demonstrating that compact spaces can still deliver high-impact experiences.

Multifamily professionals know that the real value in a property lies in offering amenities that appeal to potential renters and align with their evolving expectations and lifestyle needs. Surprisingly, only 15% of multifamily professionals track the usage of their apartment amenities, according to Multifamily Insiders. This gap represents a missed opportunity to tailor offerings that resonate with residents and maximize property value.

Today’s renters are increasingly looking for more than just a place to live — they want a lifestyle that suits their needs and preferences. For example, residents may be willing to commute a bit farther if it means having access to unique amenities like a rooftop lounge, a pet spa, or additional green space. Multifamily professionals have noted that residents are particularly “wowed” by more unconventional offerings such as blow-out hair bars, package lockers, beverage stations, and even crystal lagoons.

3. Location and Amenities as Key Investment Factors

Suburban and garden-style communities remain attractive investments, especially in areas with strong school districts and high barriers to entry. Properties that blend location advantages with desirable amenities continue outperforming competitors, driving long-term resident retention and sustained rent growth.

4. Multifamily Investment Volumes Set to Rebound

Transaction volumes are expected to increase as interest rates stabilize and capital markets become more favorable. Investors should watch for potential pricing corrections in high-supply markets, as well as opportunities to acquire well-located assets below replacement cost.

5. Fewer Investors, More Strategic Opportunities

With some traditional investors pulling back, the market is presenting unique opportunities for well-capitalized buyers. Those with access to liquidity and strong lender relationships will have the chance to acquire prime multifamily assets at competitive pricing in late 2025.

6. Oversupply Challenges in Certain Markets

Major markets that experienced a surge in new development over the past few years face oversupply concerns. Lease-up properties offer aggressive concessions, creating challenges for stabilized assets competing for renters. While long-term demand remains strong, the near-term leasing environment may require strategic pricing and marketing adjustments.

7. Aging Demographics Fueling Senior Housing Demand

As the population aged 80+ grows, senior housing is seeing increased investor interest. While new construction has slowed, demand is rising, leading to increased occupancy rates and potential consolidation within the sector.

8. AI and Tech-Driven Risk Mitigation in Insurance

With rising insurance costs, multifamily owners leverage AI-driven smart home technology to mitigate risks like water damage and fires. Properties implementing predictive maintenance solutions and IoT-enabled monitoring systems are seeing lower premiums and improved coverage terms.

9. Hyper-Targeted Marketing and Localized Outreach

Property managers are prioritizing hyper-localized marketing campaigns, leveraging partnerships with local businesses and influencers to boost engagement. Digital advertising platforms are also enabling more precise audience targeting, helping properties maximize their marketing spend.

For example, partnerships with local sports teams or cultural organizations can enhance a property’s visibility and community presence. This approach is particularly effective in markets where traditional marketing efforts may be less impactful.

Discover 10 more ways to market your business in the multifamily market through partnerships, events, sponsorships, and syndications in our blog.

10. RFlexible Workspaces Driving Renovation Strategies

Coworking-friendly apartments are in high demand, with listings featuring work-friendly amenities receiving 16% more saves and 23% more shares daily. Developers are adapting common areas to include quiet workspaces, high-speed internet, and collaborative meeting spaces to cater to the growing remote-work trend.

These renovated areas often include open kitchens, lounge seating, and work-from-home accommodations designed to create a vibrant and flexible environment for residents. By focusing on these renovations, developers can enhance the appeal of their properties and meet the evolving needs of today’s renters.

Adapting to the Future: Strategies for Multifamily Success

While the multifamily market faces economic headwinds, strategic investments and adaptability will be key to success in 2025. Developers and investors who focus on high-demand locations, technology integration, and evolving renter needs will be best positioned to capitalize on emerging opportunities. Staying ahead of these multifamily trends will ensure a competitive edge in a rapidly evolving landscape.

At Criterion.B, we’re here to help you navigate these changes and maximize the opportunities. If you want to refine your marketing strategy or explore new avenues for growth, contact our team today.